Expenses

Cost incurred by the company either directly or indirectly towards the generation of revenue.

Raaj

Last Update hace 3 años

Expenses are the cost incurred by the company either directly or indirectly towards the generation of revenue. These are incurred either on a cash basis or an accrual basis.

In the expenses, you can create a new entry for all the expenses and capital purchase edit or delete them. In TIGG expenses transactions are used to record expenses or capital purchase transactions when inventory tracking is not required.

Essential Requirement

To create and use the Expense Entry, it is essential and advisable to create the following

- Supplier

- Credit Term

- Accounts

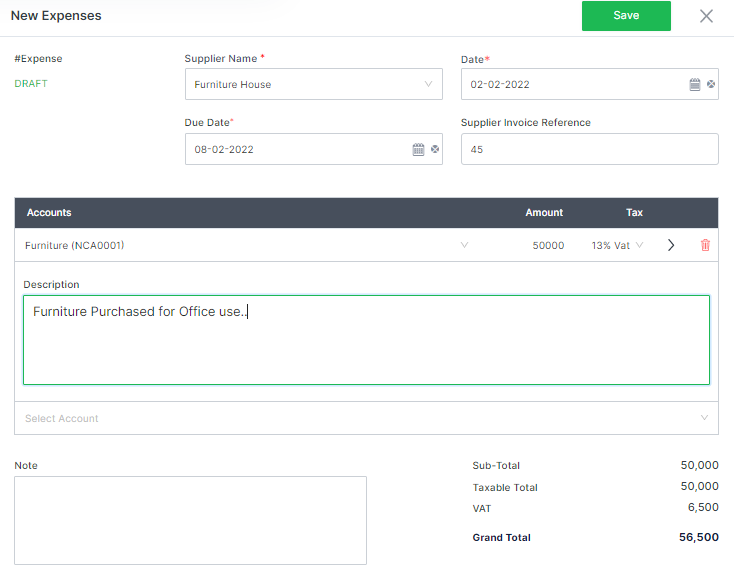

Creating New Expenses Entry

- In the Purchase module, select Expenses.

- Click on “+Add New” to create a new expenses entry.

- Unique Expenses number will be generated automatically if set to auto in configuration or fill manually if set to manual.

- Upon clicking the “Supplier Name” field, a drop-down list will appear for the existing suppliers. Select the desired supplier name from the list or type in the name manually. If the desired supplier name is not previously created, click on the “Add New” option and fill in the details to create the supplier.

- Select the “Date” from the pre-designed calendar by clicking on the calendar icon. (This can be the transaction date or the date the invoice was drawn by the supplier.)

- Select the “Due Date” by clicking on the calendar icon or by selecting the predefined Credit Terms displayed next to the calendar.

- Provide the “Suppliers Invoice Reference” as per the invoice received from the Supplier.

- Select the account from the list. If not previously created, click on “Add New” to create a new account. Or you can create new accounts in the “Accounting” module under “Chart of Accounts”.

- Enter the amount and choose Tax if applicable. Click on the arrow key next to the amount to provide an additional description for the individual accounts line or click on the delete icon to remove the account line from the list.

- Choose “TDS” if applicable. Select TDS account to record TDS payable, Select TDS type as required and TDS amount.

- You can provide notes, reporting tags and custom fields if required.

- Click on the “Save” icon. Click on the desired action from the pop-up box or click elsewhere to save the purchase order as a draft. If saved as a draft, you can approve the purchase order from the draft tab. OR

- Click on the “Reset” icon to clear all the fields and start again.

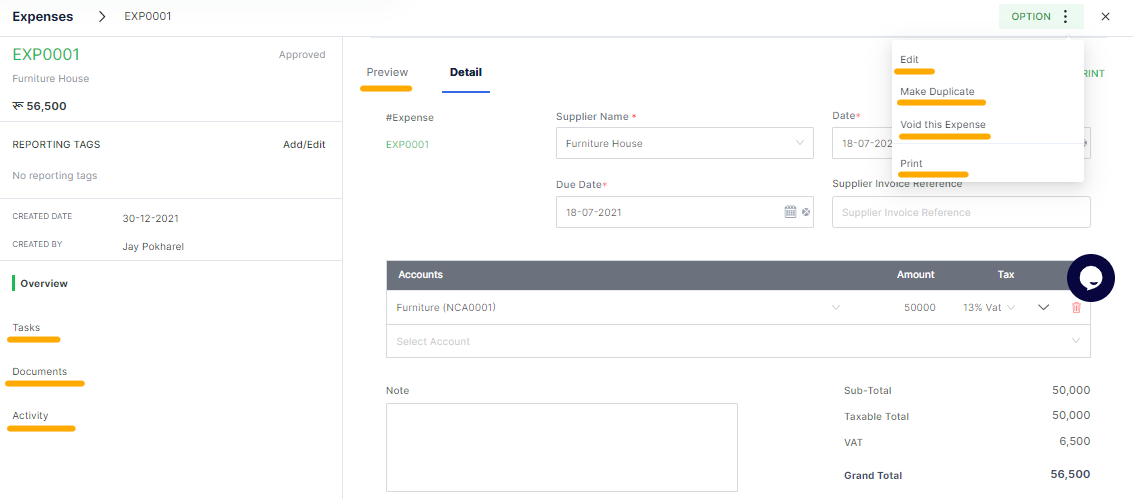

Options for Expenses

When a selected expense is opened, options can be used to edit, make duplicate, void, print the selected expenses transaction.

Quick Action Button: For the draft expense, the quick action to “Approve” will be suggested which shall approve the draft expense. If the approved expense is selected then the quick action to “ Record Payment” will be suggested which upon clicking shall direct you to record the supplier payment.

Edit Expenses– in this option, you can edit the previously created expenses entry.

Make Duplicate – if you select this option, a replica of the currently displayed expenses will be created as new expenses. You can however still edit the details/information and save it as a new expense.

Void expenses entry – This option nullifies/invalidates the currently selected expenses. Once a transaction is voided such transaction cannot be reverted later.

Print /PDF: For any document opened, may it be draft or approved, you can preview, print or save as pdf. Tigg offers a pre-designed template for the user, however, you can design/change the templates from “Configuration” in “Printing Templates”.

Field description

| Field | Description |

|---|---|

| #Expenses | Expense Entry Number |

| Supplier Name* | The seller/supplier |

| Date | The date at which the expense/s incurred |

| Due Date | The date at which the payment is made or expected (Credit Term) |

| Supplier Invoice Reference | Supplier Invoice Numbers |

| Account | Account head under which the expense is incurred/to be recorded |

| Amount | Cost of Expense before tax |

| Tax | Value-added Tax |

| Sub Total | Total without VAT after item discount |

| Discount-transaction level | Discount at transaction level |

| Non-Taxable Total | Total of non taxable product after transaction level discount |

| Taxable Total | Total of the taxable product after transaction-level discount |

| VAT | Amount of VAT |

| Grand Total | Transaction total including VAT |