Debit Notes / Purchase Return

Documents created by the buyer to the supplier indicating the cancellation/return of a certain product/service.

Raaj

Last Update vor 3 Jahren

Debit notes are the documents created by the buyer to the supplier indicating the cancellation/return of a certain product/service from one or more purchase bills. Debit note also denotes the reduction in payment obligation towards the supplier previously booked by the buyer.

In Debit Notes, you can create, edit or delete debit notes for the previous purchase bills.

Essential Requirement

To create or use debit notes, it is essential and advisable to create the following:

- Supplier Name

- Product/Service

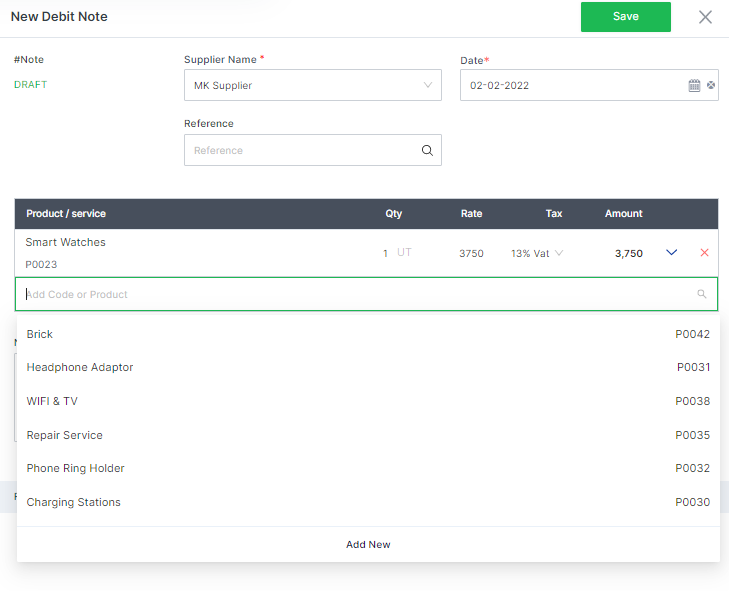

Creating New Debit Notes

- In the Purchase Module, Select Debit Notes.

- Click on “+Add New” to create a new debit note.

- Chronological Debit Note number will be generated automatically if set to auto in configuration or fill manually if set to manual.

- Upon clicking the “Supplier Name” field, a drop-down list will appear for the existing suppliers. Select the desired supplier name from the list or type in the name manually. If the desired supplier name is not previously created, click on the “Add New” option and fill in the details to create the supplier.

- Select the “Date” from the pre-designed calendar by clicking on the calendar icon.

- In the “Invoice Ref”, you can click on the search icon to enable a drop-down list of purchase bills/expenses for the selected supplier or you can manually enter the reference for the transaction.

- The list of products/services shall be automatically traced if invoice ref is selected from the previously created purchase bill/expenses entry along with information such as product/service, quantity, rate, tax and discount. If invoice ref. is entered manually, select the product/service from the drop-down list, enter quantity, rate, tax rate and discount amount manually. (You can still change/edit the information even if the invoice ref. is selected from the previously created purchase bills/expenses)

- In the “Note”, provide the relevant information for the transaction.

- Select the reporting tag to inform the designated personnel about the debit note.

- Click on the “Save” icon. Click on the desired action from the pop-up box or click elsewhere to save the debit note as a draft. If saved as a draft, you can approve the debit note from the draft tab. OR

- Click on the “Reset” icon to clear all the fields and start again.

Options for Debit Notes

When a selected supplier payment is opened, options can be used to edit, make duplicates, void, print the selected payment transaction.

Quick Action Button: For the draft debit note, the quick action to “Approve” will be suggested which shall approve the debit note.

Edit Debit Note – in this option, you can edit the previously created debit note.

Make Duplicate – if you select this option, a replica of the currently displayed Debit Note will be created as a new debit note. You can however still edit the details/information and save it as a new debit note.

Void this debit note – This option nullifies/invalidates the currently selected debit note. Once a transaction is voided such transaction cannot be reverted later.

Print /PDF: For any document opened, may it be draft or approved, you can preview, print or save as pdf. Tigg offers a pre-designed template for the user, however, you can design/change the templates from “Configuration” in “Printing Templates”.

Field description

| Field | Description |

|---|---|

| #Note | Debit Note Number |

| Supplier Name* | The seller from whom the purchase was made |

| Date | Debit note date |

| Reference | Reference or Purchase bill |

| Product/ Service | Product and services to be returned |

| Quantity | Quantity to be returned |

| Rate | Product purchase rate before discount |

| Discount-item level | Discount at the item level |

| Tax | Value-added Tax |

| Sub Total | Total without VAT after item discount |

| Discount-transaction level | Discount at the transaction level |

| Non-Taxable Total | Total of the non-taxable product after transaction-level discount |

| Taxable Total | Total of taxable product after transaction-level discount |

| VAT | Amount of VAT |

| Grand Total | Transaction total including VAT |